You can read the full article at https://developingtelecoms.com/telecom-technology/optical-fixed-networks/12705-brazil-takes-first-steps-towards-connecting-millions-in-the-country-s-north.html

You can read the full article at https://developingtelecoms.com/telecom-technology/optical-fixed-networks/12705-brazil-takes-first-steps-towards-connecting-millions-in-the-country-s-north.html

A survey commissioned by ultrafast full fibre broadband provider Truespeed reveals that the average Brit will spend the equivalent of just over three years of their life on video calls for work. According to the Lifetime of Internet survey conducted by OnePoll, checking emails amounts to a total of two years and four months over the average adult lifetime, while checking social media accounts a further three years.

The study also found that 38 per cent are already online by 8am on an average day, while 20 per cent don’t log off until after 11pm.

Despite this heavy reliance on the Internet, only around a third of adults (36 per cent) enjoy a very reliable home broadband connection. Unsurprisingly, 42 per cent experience problems with their connection at least once a week.

According to the poll, adults waste on average an hour every working week waiting for online applications or documents to load online at home. The nation is also only prepared to wait up to 23 seconds on average for something to load on the internet before losing patience.

“It’s clear that a fast and ultra-reliable broadband connection for every home is essential if we are to keep pace with people’s online needs – including working from home and leisure time,” states Evan Wienburg, CEO of Bath-based Truespeed. “And that this should not be a postcode lottery. Ensuring everyone, regardless of their location, has access to ultrafast, full fibre, highly reliable broadband connectivity will be a national gamechanger. At Truespeed we are working hard to ensure people in the South West of England have sufficient fibre-optic broadband fizz to see them through their Internet lifetime.”

You can read the full article at https://advanced-television.com/2021/10/29/survey-brits-still-frustrated-by-broadband/

August 05, 2021

Written by: Mary Cullen

GPON has been widely deployed for years, but Broadband Forum research shows likelihood of heavy growth in usage over the next several years. Managing Director Ken Ko joined the Fiber Broadband Association on a recent Fiber for Breakfast episode to discuss how these technologies are going to impact the networks of tomorrow.

Ko shared research from the Broadband Forum that shows GPON and XGS-PON capacity is running out sooner than we’d think. GPON capacity could start running into its reserves as early as 2023 and 10 Gigabit XGS-PON as early as 2028, affecting performance for users.

“Heavy growth is consistent in what I’ve actually seen and what I’ve seen documented from multiple sources in years past—not even to mention last year’s pandemic and the huge bump in growth of usage that we saw last year,” Ko noted.

While neither the projected heavy nor moderate growth rates hit the basic capacity of GPON, Ko said each growth projection exceeds GPON’s capacity minus the headroom needed in reserve.

“There needs to be enough headroom left in reserve on the PON over and above the usage that users are applying in order to actually meet the performance needs that you’re advertising for a Gigabit service,” he said.

Ko said the most common application wherein users are taking up that full Gigabit of capacity is a speed test.

“When users use that speed test, they get a direct indication of what their performance is,” he explained. “And if you haven’t left that full Gigabit in reserve, you will probably hear about it from them.”

Considering that fact and the Gigs that must be left on the reserve, Ko said we may start seeing GPON exhaustion on a 32-subscriber split as early as 2023.

“GPON, depending on your network design and the services that you’re offering, may or may not have several years of life left to it going forward in the decade,” he continued. “However, we are starting to see widespread deployment of XGS-PON, which allows for four times the capacity and close to 10 Gigabits, once you take the overhead off, as opposed to 2.5 Gigs on GPON.”

Ko said that is a vast improvement, but we must also consider that service rates are going to be steadily increasing over the years. Additionally, XGS-PON comes with its own capacity issues.

“Once you get to those higher levels of service and the amount of headroom you have to leave for them, you may or may not get to the end of the decade before you reach exhaustion with XGS-PON,” he said.

Ko noted that operators only supplying consumer services will likely reach the end of the decade without exhausting the network but acknowledged that most operators are looking at converging those consumer services with business services, which then throws another level of requirement as well as convergence opportunities.

“We really have to start considering new PON technologies in the not very distant future,” he said.

Ko noted we already know the requirements for our networks, and performance isn’t just speed. He noted considerations for latency, packet loss, security, timing and synchronization and reliability and availability. The good news is there are technologies helping to meet those requirements.

“The ITU-T is in the final stages of approving a 50 Gig PON which runs over a single lambda in each direction, and the initial recommendation—which may be approved later this year—supports 25 Gigs upstream, with a symmetric version for future study,” Ko explained. “IEEE has recently approved a 50 Gig PON as well, which runs over two wavelengths at 25 Gigs each.”

A third version that supports 25 Gigs symmetric has not been specified by ITU-T or IEEE, but by a multi-source agreement between a large group of vendors and service providers.

“These are the offerings that we are going to see in the near future for increasing PON performance,” Ko reiterated before noting that both IEEE and ITU-T are developing what is being called “SuperPON technologies” that will support up to 160 Gigabits aggregate over as many as 16 wavelengths.

“There is no shortage of innovation, or bandwidth when looking forward with modern technologies,” he concluded.

You can read the full article at https://optics.fiberbroadband.org/Full-Article/whats-next-for-the-future-of-pon

According to a new OVBI Special Report issued by OpenVault, Upstream usage grew 63% – from 19 GB to 31 GB – between December 2019 and December 2020, far outpacing the 18% rate of increase for the upstream in each of the two prior years.

According to a new OVBI Special Report issued by OpenVault, Upstream usage grew 63% – from 19 GB to 31 GB – between December 2019 and December 2020, far outpacing the 18% rate of increase for the upstream in each of the two prior years.

The report also details how average upstream traffic during the 9 a.m. – 5 p.m. timeframe grew from 5.25 GB to 10.42 GB per subscriber per month as of December 2020, a 98.5% increase, while per-subscriber monthly downstream consumption during the same period increased just 51.74%, from 91.90GB to 139.45GB.

Remote work, education, entertainment, and personal communication put significant pressure on operators’ significantly limited upstream capacity beginning in March 2020.

“Pandemic lockdowns changed the nature of upstream usage – in all likelihood, forever,” the report notes. “Continued high levels of remote work and a new embrace of videoconferencing for communication needs mean that consumption will pressure the limited upstream capacity of many broadband infrastructures. Moreover, the unique role of the upstream as an enabler of two-way communication makes unfettered performance essential.”

Intense competition in the Dutch fibre-to-the-home market has pushed the number of new connections to 533,000 in 2020.

Intense competition in the Dutch fibre-to-the-home market has pushed the number of new connections to 533,000 in 2020.

Telecompaper’s annual report on broadband coverage in the Netherlands shows that following a year of record additions 3.68 million households had an FTTH connection, about 46% of all homes in the country.

It’s anticipated that competition between KPN NetwerkNL and its rivals Delta Fiber Network, E-Fiber, and Primevest/T-Mobile will continue to benefit the consumer. Already in 2021, the major players purchased a total of over 50,000 FTTH lines from smaller parties.

KPN NetwerkNL is the largest fibre company by far with a market share of more than 75%. The company has managed to expand its total by 319,000 homes passed in 2020 and is looking to add half a million more over the next few years.

However, despite added actual numbers, KPN’s market share fell as Number two Delta Fiber Network (14%), number three E-Fiber (3%), and number four Primevest/T-Mobile (2%) all managed to expand their market share in 2020

Broadband Forum’s latest technical report has highlighted how fiber-based access could be provided using existing copper infrastructure instead of installing fiber to end-users premises.

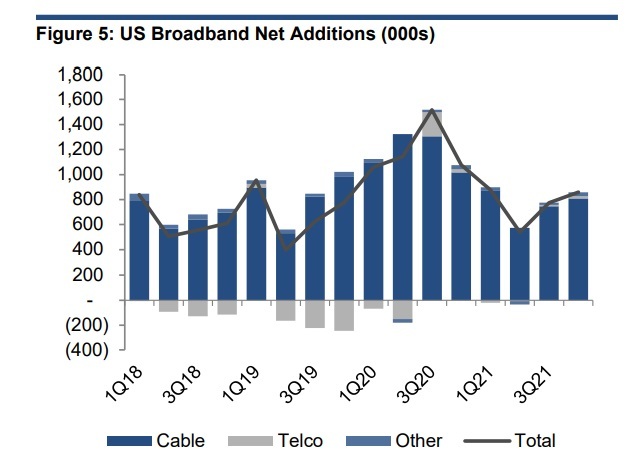

Broadband Forum’s latest technical report has highlighted how fiber-based access could be provided using existing copper infrastructure instead of installing fiber to end-users premises.US broadband providers will turn in another solid quarter in Q4 2020, but the gains won’t be high enough to match up with the blowout subscriber numbers seen in the third quarter of the year, the analysts at ISI Evercore predicted in a preview ahead of quarterly results.

US service providers are expected to add another 1.1 million broadband subscribers in Q4 2020. While those expected broadband adds will handily beat the 780,000 adds from Q4 2019, they’ll mark a slowdown from the 1.5 million broadband sub adds posted in Q3 2020 as the pandemic-fueled surge tapers off, the analysts noted.

Evercore ISI also expects cable to capture the lion’s share of broadband sub growth, with net adds of 1.01 million, or a share of about 95% of all net additions. Telcos are expected to add 24,000 broadband subs in Q4, improving on a loss of 244,000 subs a year earlier.

US satellite broadband service providers will pull in about 35,000 new subs in Q4 (-1,000 for ViaSat and +36,000 for HughesNet), the analysts predicted.

With everything rolled up, US service providers will add 1.07 million subs, versus a gain of 777,000 in the year-ago period. US cable operators are expected to end the period with 72.7 million broadband subs, compared to the telcos (26.4 million) and satellite (1.9 million). Overall US broadband penetration is slated to climb to 84.2%, up from 81.1% in the year-ago period.

ISI Evercore’s preview arrives as several US service providers, including AT&T, Verizon, Comcast, and Charter Communications, prepare to announce Q4 2020 results throughout the week.

For more detail on ISI Evercore’s quarterly preview, including its expected pay-TV tally for Q4 2020, please see this story at Light Reading: Broadband gains more ground in Q4 as pay-TV takes another hit.

see full article at http://www.broadbandworldnews.com/author.asp?section_id=733&doc_id=766882&