Broadband Forum points to harnessing copper for fiber benefits

Broadband Forum’s latest technical report has highlighted how fiber-based access could be provided using existing copper infrastructure instead of installing fiber to end-users premises.

Broadband Forum’s latest technical report has highlighted how fiber-based access could be provided using existing copper infrastructure instead of installing fiber to end-users premises. Broadband Forum’s latest technical report has highlighted how fiber-based access could be provided using existing copper infrastructure instead of installing fiber to end-users premises.

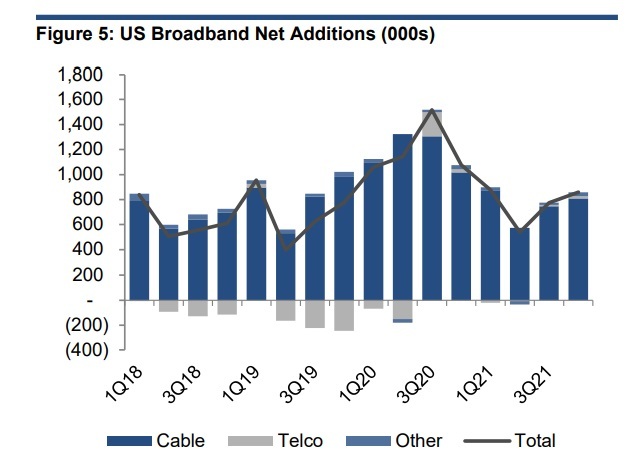

Broadband Forum’s latest technical report has highlighted how fiber-based access could be provided using existing copper infrastructure instead of installing fiber to end-users premises.US broadband providers will turn in another solid quarter in Q4 2020, but the gains won’t be high enough to match up with the blowout subscriber numbers seen in the third quarter of the year, the analysts at ISI Evercore predicted in a preview ahead of quarterly results.

US service providers are expected to add another 1.1 million broadband subscribers in Q4 2020. While those expected broadband adds will handily beat the 780,000 adds from Q4 2019, they’ll mark a slowdown from the 1.5 million broadband sub adds posted in Q3 2020 as the pandemic-fueled surge tapers off, the analysts noted.

Evercore ISI also expects cable to capture the lion’s share of broadband sub growth, with net adds of 1.01 million, or a share of about 95% of all net additions. Telcos are expected to add 24,000 broadband subs in Q4, improving on a loss of 244,000 subs a year earlier.

US satellite broadband service providers will pull in about 35,000 new subs in Q4 (-1,000 for ViaSat and +36,000 for HughesNet), the analysts predicted.

With everything rolled up, US service providers will add 1.07 million subs, versus a gain of 777,000 in the year-ago period. US cable operators are expected to end the period with 72.7 million broadband subs, compared to the telcos (26.4 million) and satellite (1.9 million). Overall US broadband penetration is slated to climb to 84.2%, up from 81.1% in the year-ago period.

ISI Evercore’s preview arrives as several US service providers, including AT&T, Verizon, Comcast, and Charter Communications, prepare to announce Q4 2020 results throughout the week.

For more detail on ISI Evercore’s quarterly preview, including its expected pay-TV tally for Q4 2020, please see this story at Light Reading: Broadband gains more ground in Q4 as pay-TV takes another hit.

see full article at http://www.broadbandworldnews.com/author.asp?section_id=733&doc_id=766882&

3 December 2020. Today at the FTTH virtual Conference 2020, the latest figures of the FTTH Forecasts for 2020 and 2026 prepared by IDATE with the FTTH Council Europe’s Market Intelligence Committee were released alongside a flash update of the 2020 FTTH Market Panorama. These numbers were reviewed after the COVID-19 initial wave during 2020.

These market forecasts cover 39 countries1 and provide an individual analysis for 15 countries2. Estimates plan for a massive surge to around 202 million homes passed for FTTH/B in 2026 in EU27+UK compared to 26,2 million in 2012. Some countries are expected to experience an outstanding growth in the number of homes passed in 2026 compared to 2019 such as Germany (+730%), the United Kingdom (+548%), and Italy (+218%).

Looking at the ranking of countries, while Russia is likely to continue leading the charge in terms of FTTH/B homes passed, it is anticipated that Germany would join the second spot in the ranking in 2026.

According to the forecasts, the number of subscribers would increase further to around 148 million in 2026 for EU27+UK and approximately 208 million for EU38+UK, and the FTTH/B take-up rate3 would reach 73,3% in 2026 showing a clear upward trend compared to a recorded 23,4% in 2012.

Covid-19 can partially explain this massive growth as it led to more data traffic and new broadband demands with people staying at home, which in turn increased the demand for fibre. But it is to be considered as an accelerator that amplified pre-existing trends.

However other factors also affect positively FTTH adoption such as:

deployments;

Finally while FTTH/B deployments are intensifying across Europe it is worth noting that a new digital divide for teleworking performance was revealed by the Covid-19 crisis. Beyond its impact on public policies, it is now clear that Covid-19 has changed public perception of the importance of broadband

1 Andorra, Austria, Belarus, Belgium, Bulgaria, Croatia, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Kazakhstan, Latvia, Lithuania, Luxembourg, Malta, Macedonia, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine and United Kingdom

2 Belarus, France, Germany, Italy, Kazakhstan, Netherlands, Poland, Portugal, Romania, Russia, Spain, Sweden, Turkey, Ukraine, UK 3 Take-up rate=Subscribers/Homes Passed

Press release

and their willingness to accept premium for fibre. This new trend is one of the key drivers for the very high estimates for FTTH/B take up however additional measures by policy-makers aimed at increasing take-up are still crucial for European citizens and businesses to benefit from the potential of full fibre.

The presentation about the Market Panorama 2020 (figures from September 2019 and excluding the update presented at the FTTH virtual Conference on 3 December) is available here and the corresponding press release here.

September 09, 2020

Nokia announced it has been awarded a contract with Open Fiber, Italy’s wholesale infrastructure operator, to supply cutting edge optical transport technology for the expansion of the fibre-to-the-home (FTTH) Ultra-BroadBand (UBB) network nationwide.

Nokia is supporting Open Fiber’s commitment to build a fully fibre optical UBB network to connect more than 6,000 municipalities in all the Italian regions. With the network enabling client speeds of up to 1Gb/s, the mission supports the objectives set by the Italian Gigabit Society 2025 strategy.

Nokia and SIAE Microelettronica, a Nokia technology and services partner, joined forces in a consortium to deliver the 1830 Optical Network Extender (ONE) and Network Functions Manager-Transport (NFM-T) solutions for the aggregation layer of Open Fiber’s Access Network.

The consortium will deliver services including installation and commissioning. The UBB network service will then be leased to local FTTH and fibre-to-the-premises (FTTP) operators around the country.

Part of the Nokia WaveFabric optical network solution, Nokia’s 1830 ONE suite of wavelength division multiplexing (WDM) optical transport network (OTN) metro access products is designed to have a minimal footprint while offering state-of-the-art ROADM, transport bandwidth and service grooming functionalities permitting Capex/Opex optimisation.

It has the modularity and density to enable more capacity for a greater number of connections and capabilities and is ideal for Access deployment in most topographies, including less accessible areas. Nokia already supports Open Fiber with optical line terminals (OLT) and optical network terminals (ONT) and services in rural areas of Italy.

Elisabetta Ripa, CEO of Open Fiber, says, “FTTH ultra-broadband infrastructure has proven to be a key factor for accelerating the digital transformation of our country, unlocking new opportunities for the Italian digital economy, boosting production and driving competiveness. We believe that also selecting Nokia’s optical network products and solutions will further accelerate our FTTH infrastructure plan, bringing reliability, openess and innovation to the market.”

Giuseppina Di Foggia, country senior officer of Nokia Italy, says, “We are happy that Open Fiber has confidence in Nokia’s optical solutions to expand their ultra-broadband network for the Gigabit Society new era. This agreement is an important one for Nokia Italia and our Optics Research and Development centre in Vimercate, where we meet innovation challenges with great passion, competence and professionalism. Being recognized by a partner such as Open Fiber motivates us further.”

full article at https://www.vanillaplus.com/2020/09/09/54700-nokia-open-fiber-accelerate-italian-ftth-ultra-broadband-adoption/

May 20, 2020

Open standards development organisation Broadband Forum is making key progress on delivering a vastly-improved broadband user experience with two new specifications nearing completion. Covering Quality Attenuation and IP Capacity Metrics and Measurements, the specifications will enable operators to achieve enhanced network performance by moving away from the conventional metric of capacity or ‘speed’, in favour of real time monitoring of network performance and operation.

Ahead of the new technical specifications – Quality Attenuation Architecture and Requirements (WT-452.1) and Maximum IP-Layer Capacity Metric, Related Metrics, and Measurements (WT-471) – Broadband Forum’s Access and Transport Architecture (ATA) Work Area has released two new white papers from its Performance, Experience and Application Testing (PEAT) Project Stream.

The work builds on Broadband Forum’s Quality Experience Delivered (QED) initiative which looks beyond conventional measurements to improve the overall broadband experience and improve management of network latency, consistency, predictability and reliability. These new approaches for network measurement and monitoring drive input into service provider operations systems and will increasingly provide the data used for machine learning, analytics, and AI to provide nearly real time feedback into the network operations. This will support operators in gauging application performance, for example, a video call, and ensure networks adapt to changing application traffic loads to always deliver the best performance to the subscriber.

“While capacity or speed is necessary, what customers actually want is for all their applications to just work consistently well; such as video streams without glitches or buffering, video calls, remote working, or uninterrupted gaming,” notes Gavin Young, Head of Fixed Access Centre of Excellence – Vodafone. “As emphasis is increasingly placed on the quality of broadband, operators can no longer differentiate on capacity alone, and instead must look to also measure and manage the reliability, network responsiveness, consistency and predictability of the services offered.”

The first white paper, Motivation for Quality Verified Broadband Services (Broadband QED) (MR-452.1), describes the motivation for Broadband Forum’s work on quality-based broadband delivery with a specific focus on a measurement and analysis framework known as Quality Attenuation. This will enable a high fidelity analysis to allow operators to gain greater understanding of network performance which, in turn, can help them focus their resources in the design and operation of their networks to improve overall customer experience.

The Maximum IP-Layer Capacity Metric and Measurement (MR-471.1) white paper looks at Transmission Control Protocol (TCP) in measuring connectivity capacity and the issues it introduces, in particular measuring connectivity at 1 gigabit/sec and above. Up until recently, TCP was the basis for capacity testing and is used in a number of commercially available ‘speed tests’. The white paper describes the motivation behind using User Datagram Protocol (UDP)-based IP Capacity metrics and measurement methods. According to the white paper, the new Maximum IP-Layer Capacity Metric and Method(s) of Measurement based on UDP closes the gap between actual service rates and TCP’s underestimations, removing the issues noted.

“The new metrics and measurement method can measure the new Gigabit services and beyond without the artefacts of TCP performance, such as its throughput sensitivity to packet loss, round-trip time and its flow control details,” advises Al Morton, Lead Member of Technical Staff at AT&T. “In addition, it measures other important performance metrics beyond speed.”

The work is continuing for both projects, including data models, open source development and additional market updates

full article at https://advanced-television.com/2020/05/20/broadband-forum-reports-qoe-progress/

May 2020

April 23, 2020

The FTTH Council Europe has revealed the 2020 Market Panorama and the latest figures outlining fibre deployment trends in Europe prepared by research institute IDATE.

Market Panorama & key findings:

The total number of homes passed with Fibre to the Home (FTTH) and Fibre to the Building (FTTB) in the EU39 reached nearly 172 million homes compared to 160 million in 2018 with now 19 countries counting more than 2 million homes passed. The main movers in terms of homes passed in absolute numbers are France (+3,5 M), Italy (+1,9 M) and Spain (+1,5 M). The top 5 of the annual growth rates in terms of homes passed is headed by Belgium (+307 per cent), Ireland (+70.4 per cent), Switzerland (+69.1 per cent), United Kingdom (+50.8 per cent) and Germany (33.5 per cent).

The coverage of both FTTH and FTTB networks in September 2019 was almost 50 per cent. By September 2019, EU39 reached a 49.9 per cent coverage of FTTH/B networks while EU28 39.4 per cent, compared to respectively 46.4 per cent and 36.4 per cent in 2018. This shows a clear upward trend from the September 2015 figures when the coverage was at 39.8 per cent in EU39 and 27.2 per cent in EU28.

The number of FTTH and FTTB subscribers in Europe increased by 15.0 per cent in EU39 since September 2018 with 70.4 million FTTH/B subscribers in September 2019. Russia still plays a major role in this increase, however, it is interesting to note that the EU28 experienced a 20.9 per cent increase on its own.

This year, the country adding the most subscribers is located in Western Europe. France added 1.923.000 new FTTH/B subscriptions and Spain came second adding 1.650.820 new FTTH/B subscribers. Other countries also experienced an outstanding increase in their number of subscribers such as Greece (+285 per cent), Ireland (+185 per cent), Switzerland (+176 per cent), Belgium (+111 per cent) and Italy (+45.3 per cent).

By September 2019, the EU39 FTTH/B take-up rate elevated to 40.9 per cent in comparison to the 37.4 per cent rate registered by September 2018. For the second consecutive year, the take-up rate for EU28 surpasses the EU39’s one by reaching 43.3 per cent (as opposed to 38.2 per cent in September 2018).

According to the Council, it is interesting to note that fibre technologies have been continuously evolving during the last few years with a predominance of FTTH architecture over FTTB (60 per cent vs 40 per cent). Alternative Internet Service Providers are still constituting the largest part of FTTH/B players, with a contribution of around 56 per cent of the total fibre expansion. 41 per cent of homes are passed by former incumbent operators. This number will also evolve as some of the latter have modified their strategy deploying more FTTH solutions, migrating from existing copper based and cable-based networks towards fibre and are even intensifying copper switch-off. The role of governments and local authorities is also increasing, either directly by signing agreements with telecom players, or via public funds.

“Ubiquitous and reliable digital infrastructure has never played such a crucial role as today connecting families, enabling business activities and working from home,” stated Erzsébet Fitori, Director General of the FTTH Council Europe. “Very high capacity connectivity is not only mission critical in times of crisis but will also be fundamental for economic recovery and the transition towards a sustainable, green EU economy. Competitive investments in very high capacity networks should, therefore, remain a high political priority and we look forward to working with the EU institutions, national governments and NRAs towards removing bureaucratic and other barriers from the way of network deployment. Access to very high capacity networks faster and more cost efficiently benefits everyone!”

In terms of European FTTH/B Ranking, Iceland dethrones Latvia and tops European FTTH penetration ranking with a 65,9 per cent penetration rate. Latvia lands fifth (53,9 per cent).

Iceland becomes a leader in FTTH/B, championing the ranking followed by Belarus (62,8 per cent). Sweden (56.8 per cent) reclaims the third position from Spain (54.3 per cent) and assumes the last spot on the podium of fibre leaders.

It is worth mentioning that Belgium has significantly stepped up its efforts to deploy fibre with an increase of 307 per cent in FTTH/B homes passed and of 111 per cent in new subscribers. However, in 2020, for the first time in years, no new country has managed to enter the FTTH/B European ranking.

In the German broadband market, FTTH/B currently represents 7 per cent of total broadband connections. The fixed broadband market remains largely dominated by copper-based technologies (52 per cent) and cable-based services. However, the BMVI (Ministry of Transport and Digital Infrastructure) launched a national programme that aims to build a ‘Gigabit Society’ in Germany by 2025.

By September 2019, Germany reached more than 4.1 million homes passed with FTTH/B and nearly 1.35 million FTTH/B subscribers. Though Germany remains quite low in the European ranking with a penetration rate of 3.3 per cent, the number of fibre subscriptions grew by 42 per cent (compared to 18 per cent in September 2018) and the number of homes passed with FTTH/B by 34 per cent (compared to 15 per cent last year).

“The data of this new edition of our Market Panorama confirm the trend that fibre roll-outs are taking place at an increasingly faster pace in Europe.” commented Kees de Waard, President of the FTTH Council Europe. “The implementation of the new European Electronic Communications Code and in particular of its Very-High Capacity Networks provision will be essential to meet the ambitions of a Gigabit connected Society in Europe, of which FTTH/B networks, which are the only future-proof infrastructure, are the foundations.”

full article at https://advanced-television.com/2020/04/23/study-172m-euro-ftth-homes/